unified estate and gift tax credit 2021

Those taxpayers were required to use their applicable exclusion amount to defray any gift or estate tax imposed on the transfer or were required to. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

Estate Tax And Gift Tax Rates For 2022 And Earlier Tax Years

Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021.

. All people are qualified to take advantage of this tax perk from the Internal Revenue Service. A tax credit that is afforded to every man woman and child in America by the IRS. Or of course you can use the unified tax credit to do a little bit of both.

A person giving the gifts has a lifetime exemption from paying taxes on those. Your available Unified Credit is effectively reduced from 1206 million to 12 million. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Gift and Estate Tax Exemptions The Unified Credit. Property Tax DeductionCredit Eligibility. The unified tax credit changes regularly depending on regulations.

What Is the Unified Tax Credit Amount for 2022. What Is the Unified Tax Credit Amount for 2021. The unified tax credit is designed to decrease the tax bill of the individual or estate.

The Tax Collector provide the necessary cash to fund. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. Tax Collector will empty lockbox Monday through Friday.

For 2021 the estate and gift tax exemption stands at 117 million per person. However with a new. Or of course you can use the unified tax credit to do a little bit of both.

Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption. The unified gift and estate. Then there is the exemption for gifts and estate taxes.

If you die in 2022 after making such a taxable gift you will still be able to transfer assets worth 2 million. The gift and estate tax exemptions. The estate and gift tax exemption is 117 million per individual up from 1158 million in 2020.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax. The Internal Revenue Service announced today the official estate and gift tax limits for 2021. Payments dropped off after 300 pm will be processed the next business day.

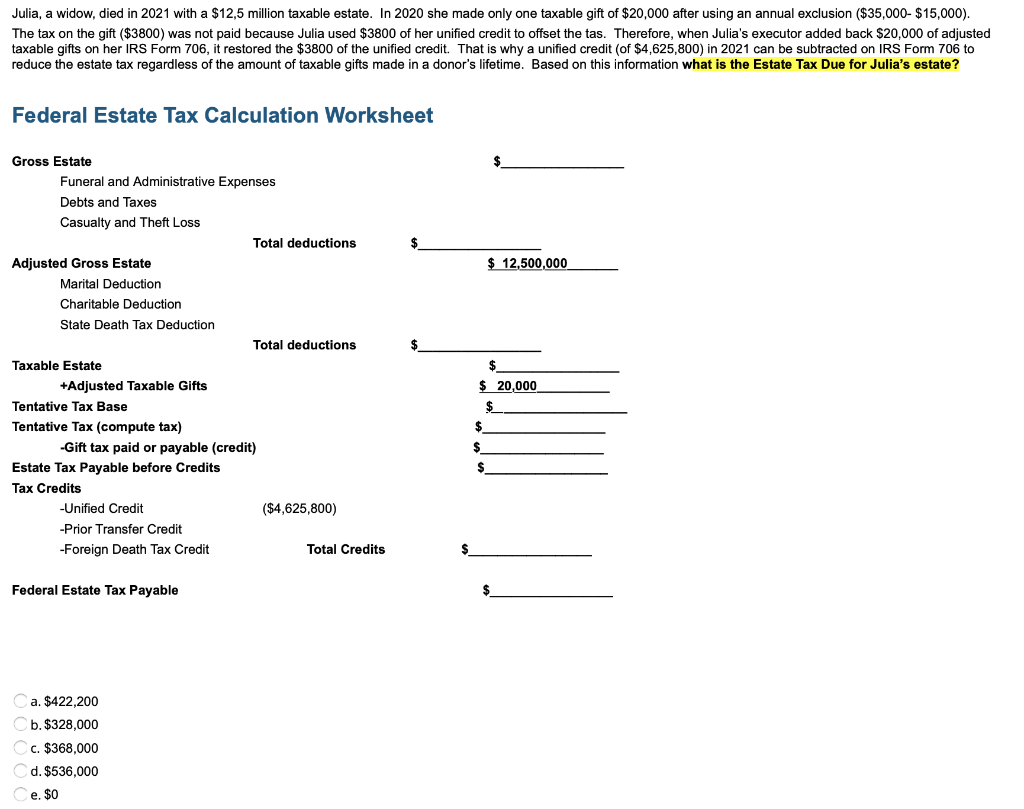

So if you made a gift to your child of 50000 to help. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Most relatively simple estates cash publicly traded securities small.

This credit allows each person to gift a certain amount of their assets to other parties. The unified tax credit applies to two or more different tax credits that apply to similar taxes. Any tax due is.

If you were both a. You are eligible for a property tax deduction or a property tax credit only if. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

What Is the Unified Tax Credit Amount for 2021. A unified tax credit allows you to gift assets without having to pay transfer taxes in some cases. The unified tax credit changes regularly depending on regulations.

A taxpayer does not incur a federal gift tax liability until the aggregate taxable gifts made over the taxpayers lifetime exceed 5430000. In the case of estate and gift taxes the unified tax credit provides a set amount that any.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Proposed Changes To The Federal Estate Gift Tax Exemption Brmm

How The U S Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Federal Estate Gift Taxes Code Regs Including Related Income Tax Provisions As Of March 2021 Cch Editorial Staff 9780808055969 Amazon Com Books

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Is There A Federal Inheritance Tax Legalzoom

Julia A Widow Died In 2021 With A 12 5 Million Chegg Com

A Simple Solution To The Estate Gift Tax Quandary Agency One

Irs Announced New Lifetime And Gift Tax Exemptions Texas Trust Law

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

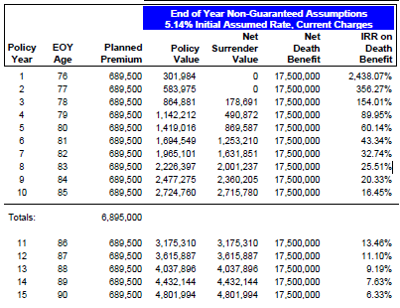

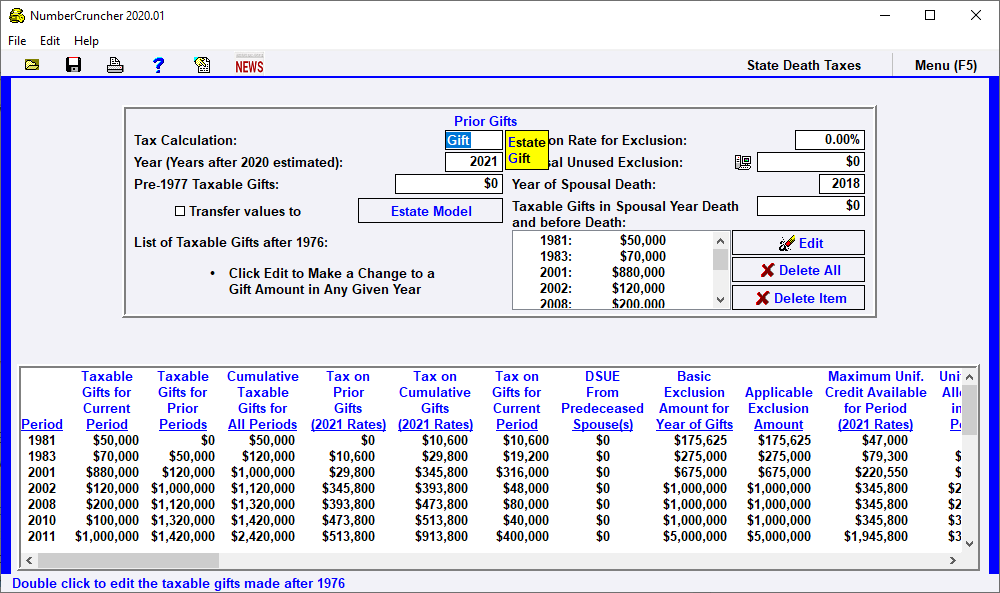

Prior Gifts Leimberg Leclair Lackner Inc

:max_bytes(150000):strip_icc()/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)