where do i pay overdue excise tax in ma

If you dont pay your excise bill and we deny your abatement you will have to pay. 40 - Year 3.

Motor Vehicle Excise Tax Wellesley Ma

Get the ins and outs on paying the motor vehicle excise tax to your city or town hall.

. Ad AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. This guide is not designed to address all questions which may arise nor to address. Pay your excise tax.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Payment at this point must be made through our Deputy. TAX INQUIRES MUST EMAIL treasurersaugus-magov.

Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. The city or town where the vehicle is principally garaged levies the excise and. When you register your motor vehicle or trailer you have to pay a motor vehicle and trailer excise.

Supports suppliers distributors and traders dealing with indirect excise taxes. Please note for new vehicles released in the calendar. They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website.

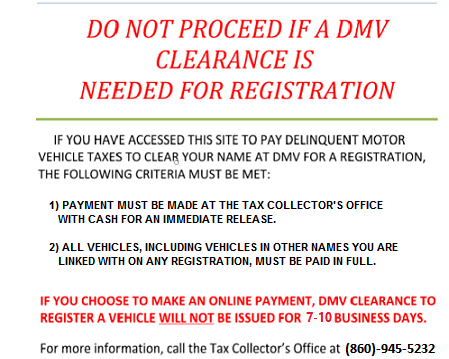

How do I pay overdue North Reading Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Tax information for income tax purposes must be requested in writing. Visit their website here.

Effective August 1 2018. Current Fiscal Year Tax Rate. 90 - Year 1 where the model year of vehicle is the same as the Excise Tax year 60 - Year 2.

Facebook page opens in new window. How do I pay overdue Excise Taxes that have been marked at the Registry of. You pay an excise instead of.

Winter and summer clothes name. MA Registry of Motor Vehicles. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Get your bill in the mail before calling. 10 - Year 5. The owner must pay the motor vehicle excise to the city or town in which heshe resided on 01-01.

Can I pay my overdue Motor Vehicle Excise taxes at Town Hall or do I have to go to the Deputy Collector. Carver Town Hall 108 Main Street Carver MA 02330 508 866. Pay Delinquent Excise.

Kelly Ryan Associates 3 Rosenfeld Dr. 25 - Year 4. Where do you pay late Motor Vehicle Excise taxes.

Please contact our Deputy Collector Jeffery Jeffery 137 Main Street Ware MA 01082-0720 or by phone at 413-967-9941. If you plan to file an abatement its a good idea to pay your excise tax. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

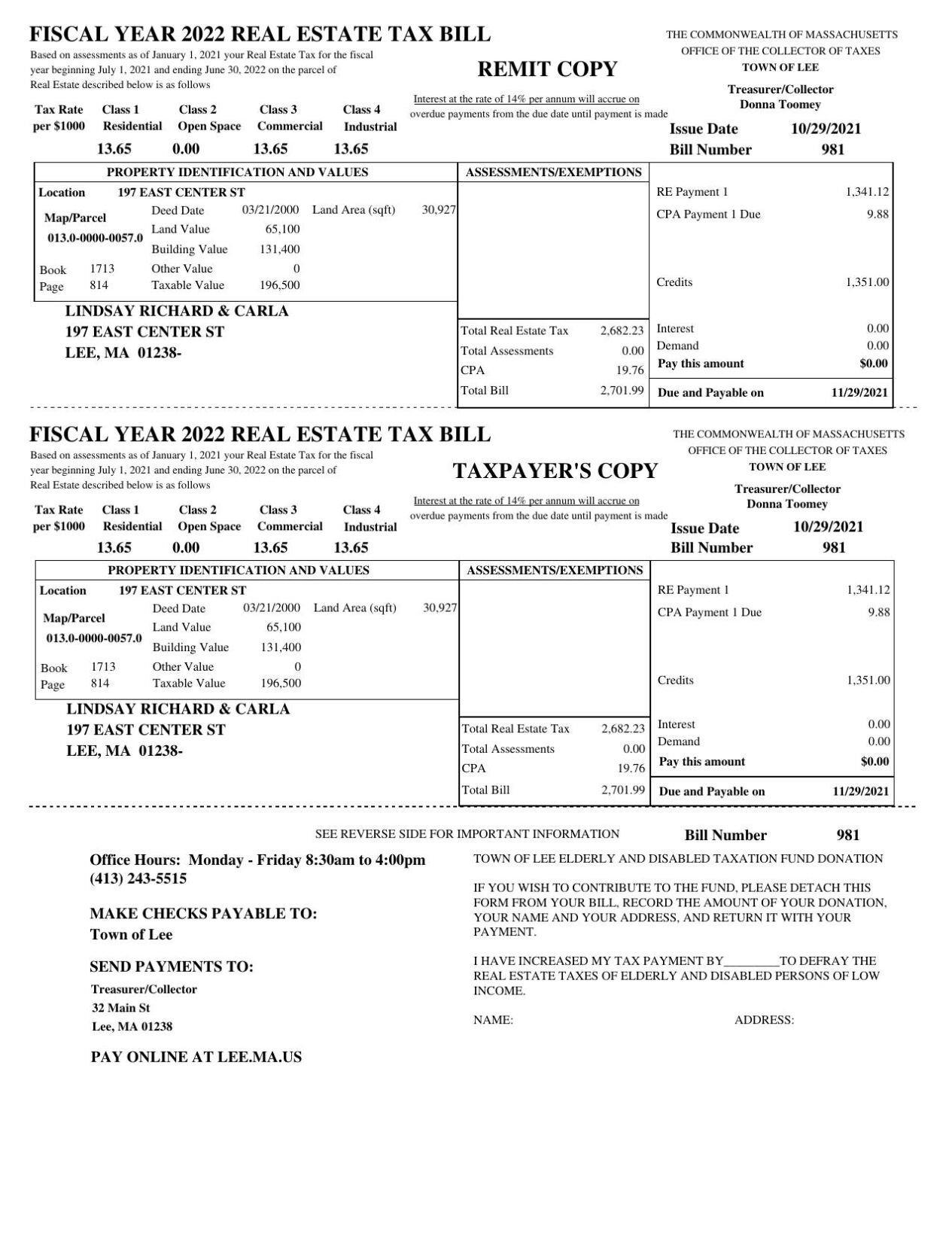

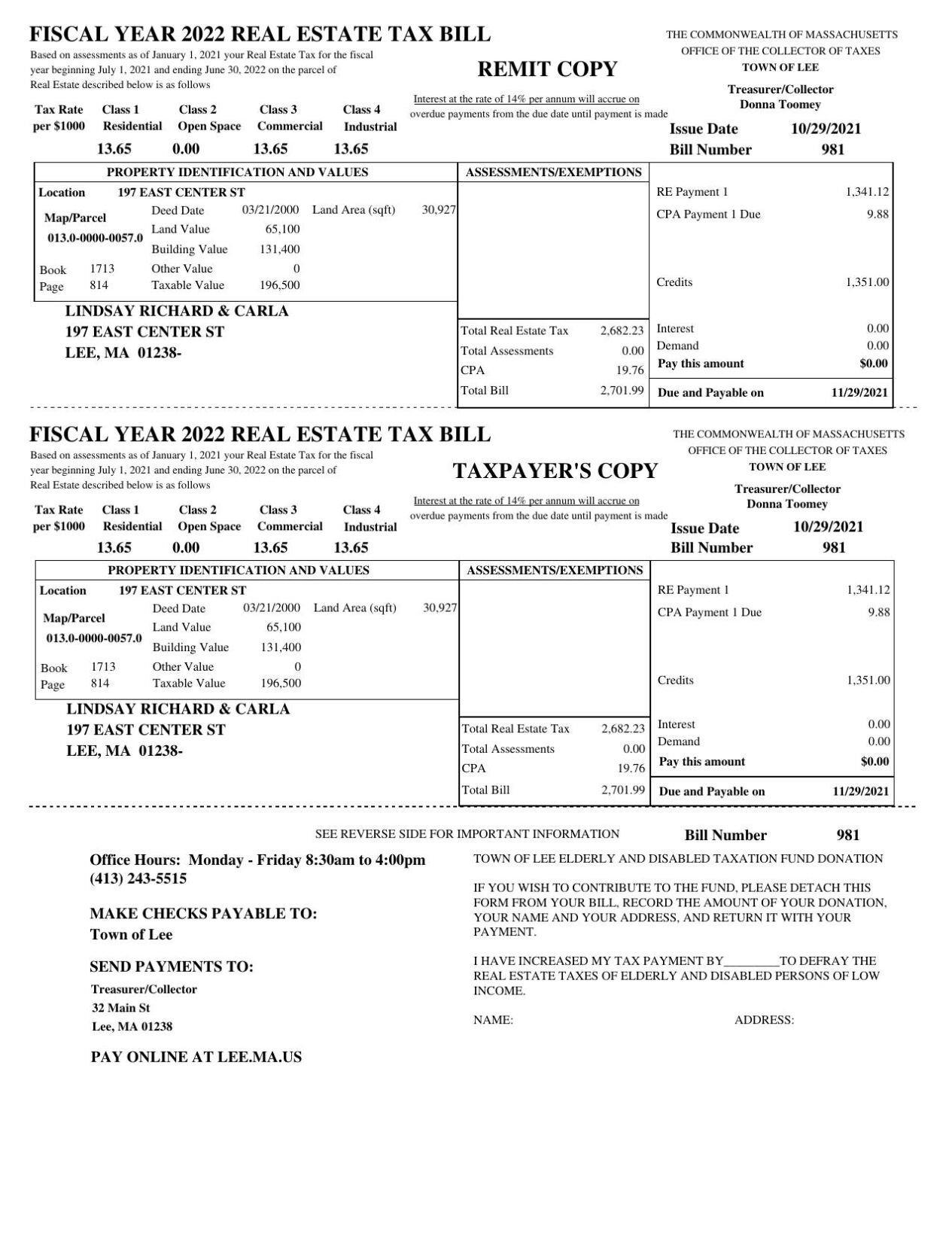

How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Online Bill Pay for Real Estate Personal Property Excise Utility. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the.

Jefffery Jeffery no. Please contact the treasuercollectors office or our Deputy Collector Kelly and. Hopedale MA 01747 508-473-9660.

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

2022 Federal Tax Deadlines For Your Small Business

Online Bill Payment Town Of Dartmouth Ma

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Ma Indirect Tax Goods And Service Tax Tax Credits

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

Town Of Watertown Tax Bills Search Pay

2021 Motor Vehicle Excise Tax Bills Fairhavenma

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Sales Tax Small Business Guide Truic

How To Register For A Sales Tax Permit Taxjar

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors